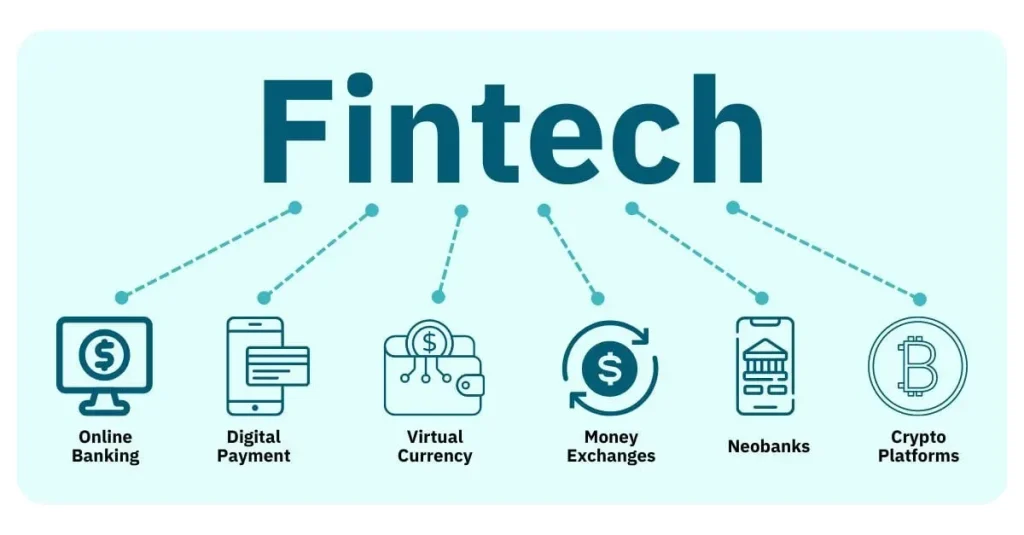

FinTech in finance is redefining how money moves, decisions are made, and services are delivered. As technology accelerates, fintech and financial technology drive faster payments, smarter underwriting, and broader financial inclusion, including AI in finance. For consumers, digital banking experiences offer streamlined onboarding, real-time updates, and smarter personal finance tools. For businesses, open banking frameworks unlock embedded finance capabilities and data-driven workflows across ecosystems. This evolution hinges on data, risk management, and trusted platforms that widen access while lowering costs.

Beyond terminology, the technology-enabled financial services landscape, also known as the financial technology sector, continues to reshape markets. The shift toward digital banking as a service shows how data portability and trust empower smarter lending and payments. As regulatory tech and AI in finance mature, institutions partner with fintech to offer seamless, secure experiences through open banking-enabled platforms. Together, these shifts create interoperable ecosystems that place customers at the center of financial innovation.

FinTech in finance: Transforming Digital Banking, Payments, and Customer Experience

FinTech in finance is redefining what it means to manage money. By combining software engineering, data analytics, and secure cloud platforms, fintech and financial technology empower faster onboarding, real-time payments, and personalized digital banking experiences. This shift is visible in digital banking apps, merchant payments, and consumer wallets that feel seamless yet powerful.

Across both consumer and business realms, FinTech in finance accelerates value by leveraging APIs, open banking capabilities, and intelligent automation. The convergence of data, risk scoring, and compliant processes enables more inclusive access to credit, savings, and investment products while maintaining trust and security through robust cybersecurity and regtech practices.

Open Banking and API-Driven Ecosystems: Collaboration Beyond Traditional Banking

Open banking and API-driven ecosystems are enabling a new generation of financial services. By exposing secure data with customer consent, banks invite fintechs and technology vendors to co-create experiences that blend payments, budgeting, and lending into one interface. This collaboration accelerates innovation and expands the reach of financial technology across sectors.

For consumers, open banking translates into smarter product recommendations, faster onboarding, and more transparent pricing. For merchants and enterprises, API-enabled platforms unlock embedded finance and real-time liquidity management, while staying compliant with data privacy and regulatory requirements.

AI in Finance: From Underwriting to Personalized Advisory

AI in finance is moving from back-office optimization to front-line decision making. Machine learning models power credit scoring, fraud detection, and automated underwriting, delivering faster decisions without sacrificing risk controls. Robo-advisors and intelligent assistants bring sophisticated investment and budgeting guidance to a wider audience.

At the operational level, AI enhances efficiency by automating routine tasks, anomaly detection, and trading analytics. Financial technology customers benefit from more accurate forecasting, personalized recommendations, and scalable compliance monitoring as data streams grow.

Digital Banking and Neobanks: Redefining the Customer Experience

Digital banking platforms and neobanks redefine how people interact with money. Intuitive interfaces, real-time alerts, and transparent pricing raise the bar for user experience in the financial services space. These digital-only models rely on modern cloud infrastructure and API integrations to offer feature-rich services without traditional branch networks.

For institutions, digital banking accelerates speed to market, enables modular product suites, and supports embedded finance. Consumers gain access to budgeting tools, savings goals, and seamless payments, while banks compete on convenience, security, and personalization rather than branch presence.

Blockchain, Settlement, and Tokenization: Enhancing Transparency in FinTech

Blockchain and distributed ledger technology underpin faster, more transparent settlement across borders and asset classes. In areas like cross-border payments and trade finance, distributed ledgers reduce settlement risk and enable near real-time reconciliation. This capability is a core pillar of modern financial technology ecosystems.

Tokenization and interoperable blockchains open new liquidity and investment opportunities. Regulators and practitioners must address governance, scalability, and compliance, but the potential for tokenized assets, programmable money, and secure audit trails remains a powerful driver for fintech innovation.

RegTech, Security, and the Path to Trusted FinTech Adoption

As fintech and financial technology scale, cybersecurity and data privacy become foundational. Banks and fintechs invest in identity verification, threat monitoring, and secure-by-design architectures to protect customers and preserve trust in digital channels. Regulatory technology, or regtech, helps organizations keep pace with evolving rules while enabling responsible innovation.

Interoperability, data quality, and governance are critical as APIs connect ecosystems of banks, fintechs, and merchants. Consistent data standards, robust KYC/ AML processes, and ongoing talent development ensure sustainable growth and risk management in a fast-evolving fintech landscape.

Frequently Asked Questions

What is FinTech in finance and why is it transformative for consumers and businesses?

FinTech in finance refers to using software, data, and advanced technologies to deliver financial services more efficiently and inclusively. It spans digital banking, AI in finance, open banking, and blockchain, enabling faster payments, smarter risk assessment, and personalized experiences. This transformation drives efficiency, broader access to financial products, and new business models across the financial ecosystem.

How does digital banking fit into the FinTech in finance ecosystem?

Digital banking is a core facet of FinTech in finance, with neobanks and challenger banks delivering intuitive interfaces, real-time alerts, and transparent pricing. It leverages APIs, cloud infrastructure, and data analytics to compete with traditional banks while integrating with broader fintech services like budgeting, savings goals, and automated investments.

What is open banking and how does it power FinTech in finance?

Open banking uses standardized APIs and customer-consented data sharing to let third-party providers build innovative services on banking rails. This collaboration accelerates competition and enables embedded finance, faster payments, and personalized financial experiences across fintechs and traditional banks.

How is AI in finance used within FinTech in finance to improve underwriting and risk management?

AI in finance powers credit scoring, fraud detection, and automated customer support. Robo-advisors, risk dashboards, and automated decisioning provide sophisticated tools at scale, improving efficiency while maintaining a focus on data quality and governance.

What are the regulatory and cybersecurity considerations for FinTech in finance?

Security and data privacy are critical as activities move online. FinTechs and banks rely on strong identity verification, ongoing monitoring, robust cybersecurity measures, and regtech-enabled compliance to address cross-border and data usage challenges.

How might blockchain, CBDCs, and embedded finance shape the future of FinTech in finance?

Blockchain and distributed ledger technology can speed up settlement, enhance transparency, and enable new asset classes, while central bank digital currencies (CBDCs) redefine value transfer. Combined with embedded finance and open API ecosystems, these trends expand fintech reach into everyday platforms and services.

| Topic | Key Points |

|---|---|

| Definition and scope | FinTech in finance uses software, data, and advanced technologies to perform financial functions more efficiently, securely, and inclusively. It spans digital wallets, open banking-enabled platforms, AI-driven underwriting, and blockchain-based settlement systems. |

| Drivers | Convergence of technology and finance accelerated by smartphones, cloud computing, and digitization of payments; data and trust enable tailored products, automated decision-making, and risk management at scale. |

| Digital Banking | Neobanks and challenger banks redefine customer experience through intuitive interfaces, real-time notifications, transparent pricing, APIs, cloud infrastructure, and analytics. |

| Open Banking | Standardized APIs with customer consent enable third-party providers to build innovative services on banking rails, fostering collaboration between fintechs and banks. |

| AI in Finance | AI/ML underpin credit scoring, fraud detection, robo-advisors, chatbots, and risk dashboards; increases efficiency by automating tasks and optimizing strategies. |

| Blockchain & DLT | Blockchain improves settlement speed, transparency, and security in cross-border payments, trade finance, and asset tokenization; not a cure-all but increasingly used. |

| Ecosystem Impact | Consumers gain access to credit and cheaper services; businesses benefit from automation and embedded finance; institutions shift toward platform-centric models with new revenue streams. |

| Challenges | Cybersecurity, data privacy, regtech, interoperability, data quality, and talent gaps; need robust security, standardized data schemas, and ongoing workforce training. |

| Long-Term Trajectory | Continued digitization, deeper embedded finance, platform integrations, and cross-sector collaboration driving scale and resilience. |

| Future Themes | Regtech and responsible AI; more blockchain-enabled solutions; CBDCs and digital asset ecosystems; open architectures and API-driven ecosystems. |

| Summary | FinTech in finance is a dynamic, evolving set of technologies, business models, and regulatory practices that push the financial system toward greater efficiency, inclusion, and resilience. |

Summary

Conclusion: The rise of FinTech in finance signals a broader shift toward an integrated, data-driven, and customer-centric financial services ecosystem. By embracing digital banking, open banking, AI in finance, and blockchain-enabled solutions, financial providers can deliver more value with greater efficiency while upholding trust and security. The story of FinTech in finance is just beginning, and its next chapters will be written by those who combine technical innovation with thoughtful governance and collaboration across the entire financial ecosystem.